.png)

.png)

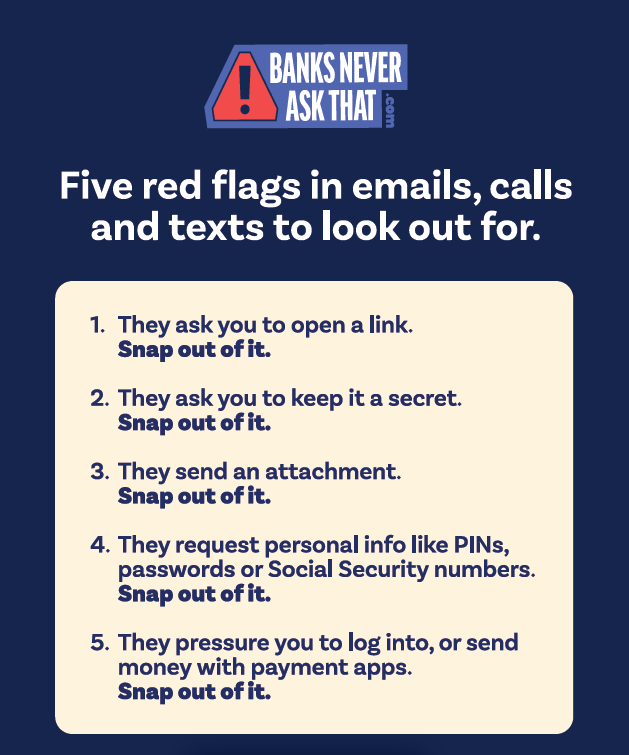

Snap Out of It: Banks Never Ask That

Fraudulent emails, texts, and calls from scammers pretending to be your bank, a loved one, the government, or law enforcement are on the rise. And with more people using online and mobile banking, the risk is growing.

In fact, the Federal Trade Commission reports that American consumers lost a staggering $16 billion to scams and fraud in 2024—a 25% increase over 2023.

Scams Aren’t So Scary When You Know What to Look For

At Range Bank, your financial security is our top priority. That’s why we’ve partnered with the American Bankers Association and joined banks across the country in the #BanksNeverAskThat campaign.

These criminals are skilled at tricking you—convincing you to trust them, act fast, and hand over sensitive information. But with the right tools, you can spot the red flags and stop scammers in their tracks.

We want every customer to feel confident and secure. That’s why we’re sharing tools to help you recognize scams before they happen.

- Watch videos

- Take the interactive quiz

- Get tips to protect your account

Visit https://www.banksneveraskthat.com to get started.

Got scammed? Take Action.

- Contact Range Bank by calling (877) 441-4042

- Change your passwords and visit IdentityTheft.gov

- Report the scam to the FTC here

- If you lost money, file a police report