Round Up Everyday Purchases: Turn Spare Change into Savings!

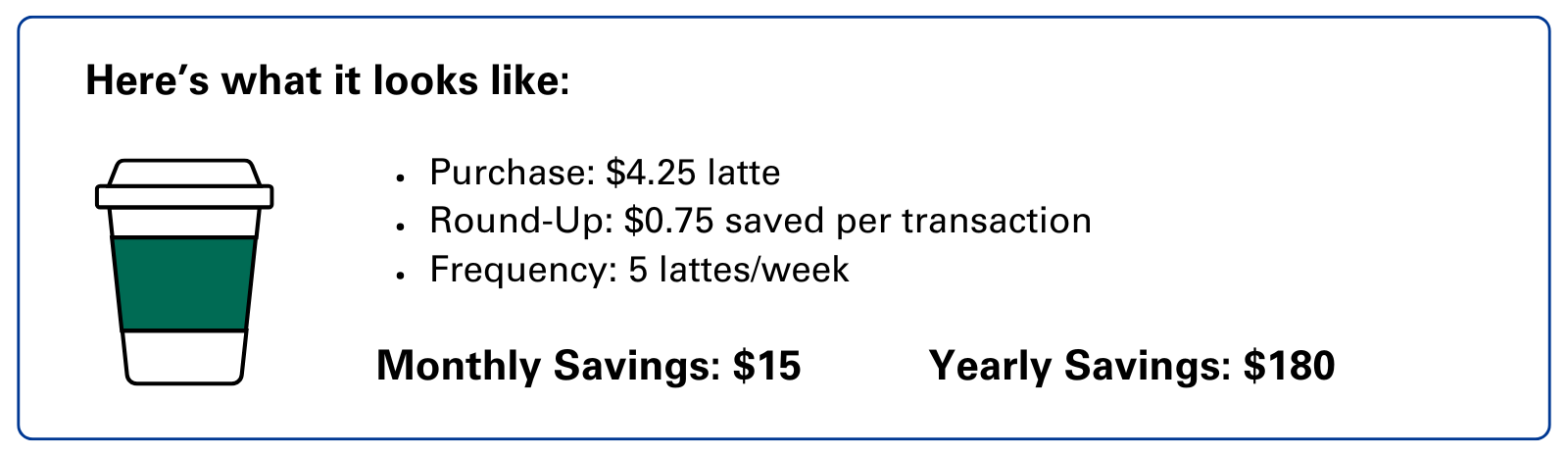

Small, consistent savings can lead to big achievements - like vacations, emergency funds, or holiday shopping. Range SaveUp allows you to automatically round up each transaction to the nearest dollar and transfer the difference into a savings account!

Contact us to get started!

.png)

.png)

.png)

.png)

.png)

The round-ups from your debit card purchases and ATM transactions are accumulated and transferred daily from your checking account to the enrolled savings account.

FAQ

How do I Sign Up for SaveUp

It's easy! You can enroll through digital banking, submit a contact form on our website, give us a call, or stop by a branch. We'll take care of the rest.

Do I need to open new accounts to use SaveUp

Not at all! We can link your existing checking and savings accounts - no new accounts required.

Is there a fee to use saveUp

Nope! SaveUp is completely free - there's no cost to participate.

which transactions qualify for saveup

Every debit card and ATM purchase counts! We'll round up each one and include it in your daily SaveUp transfer.

How will saveup transfers show on my account

You'll see one daily transaction for the total amount rounded up from your purchases. It will appear as "SaveUp Transfer."

Will SaveUp Cause an Overdraft fee if don't have enough money

No worries - SaveUp will never trigger an overdraft. If rounding up would overdraw your account, the transfer simply won't happen.

.png)

By enrolling in the Range SaveUp Program, you authorize Range Bank to round up your debit card and ATM transactions to the nearest dollar and transfer the difference from your checking account to the enrolled savings account. It is your responsibility to maintain your ownership of the checking and savings accounts enrolled in Range SaveUp. At our discretion, we may cancel or modify the SaveUp program at any time for any reason. The Range SaveUp Program is not available for business accounts.

From time to time, Range Bank may offer promotional matches to your SaveUp transfers. If we provide a promotional match, the amount contributed by the bank is considered interest or bonus income and may be reportable to the IRS. If the total promotional match you receive in a calendar year meets IRS reporting requirements, Range Bank will issue you a Form 1099-INT (or other applicable tax form) for that amount.

.png)